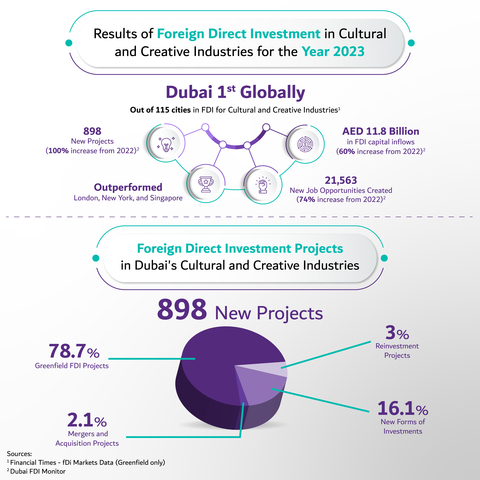

DUBAI, United Arab Emirates--(BUSINESS WIRE)--Dubai has topped the Foreign Direct Investment (FDI) Index for cultural and creative industries in 2023, according to the 'fDi Markets' report by the Financial Times. This ranking reaffirms Dubai’s leadership and enhances its competitiveness as a global capital of the creative economy.

The emirate ranked first globally as the top destination for job creation and capital inflows in the cultural and creative industries (CCI) sector, out of 115 other destinations in the report. This achievement places Dubai ahead of major global cities such as London, New York, and Singapore.

According to data from the Dubai FDI Monitor, released by the Dubai Department of Economy and Tourism (DET), Dubai has attracted 898 projects in the cultural and creative industries sector in 2023, almost double the figure from the previous year. This led to AED 11.8 billion in FDI capital inflow, which was a 60% increase. An estimated 21,563 new job opportunities were created in 2023, 74% up on 2022.

Within the ranking of the top five source countries for FDI capital inflows into CCI in Dubai during 2023, data from the Dubai FDI Monitor and the Dubai Framework for Cultural Statistics showed an increase in capital inflows. The US led with 33.2%, followed by the UK at 12.4%, India with 9.1%, Hungary on 4%, and Denmark’s 3%. The US also topped the list for creating new job opportunities through FDI into Dubai’s CCI with 19.2%, India boasting 16.3%, the UK 15.7%, Singapore with 5%, and France’s 4.2%.

In terms of the number of FDI projects announced in 2023 in the CCI sector, the UK led with 17.8%, followed by India with 16.9%, the US at 16%, France with 4%, and Italy’s 3.8%, highlighting Dubai’s efforts and strategies to focus on these markets as key partners.

Data from the Dubai FDI Monitor and the Dubai Framework for Cultural Statistics indicated that wholly-owned Greenfield FDI projects accounted for 78.7% of Dubai’s total CCI in 2023. New Forms of Investments (NFIs) were 16.1%, reinvestment projects made up 3%, and mergers and acquisitions tallied up to 2.1% of the projects in the registered sectors.

Source: AETOSWire